Lazard started out as a French retail clothing store in New Orleans. In San Francisco, the firm expanded into importing/exporting gold to New York, France, and England. These three hubs of commerce would later become the firm's focus of operation. Lazard takes its next major leap into the investment services arena during the 1920s speculative short-selling of the Franc. As an adviser credited with keeping the French Government out of a financial crisis, it chose not to flaunt in the media the same name recognition of rivals like JP Morgan. Following their successes in France, the company put together a mutual fund that consistently had capitalization issues, managerial theft, and overexposure to inflated markets. Due to Glass-Steagall and their recent success in advisory services, Lazard went into the advisory side of investment banking and not commercial banking. The bank's brand positioning as "brilliant advisers" behind the scenes would make it a favorite of self-aggrandizing corporate executives up into the 1990s.

During France's occupation by the Nazi's, Lazard had to change its decentralized corporate structure. It started the tradition of placing the responsibilities of corporate governance, employee compensation, and hiring and firing under one single person - Andre Meyer. Meyer fled from Nazi-occupied France due to his Jewish ancestry and relocated to New York with the aid of his politically influential contacts. New York became the designated headquarters for the firm with franchises in London and Paris.

Andre Meyer doubled down on the idea of Lazard as banks' advisory business and hire "Great Men" who would be valued by corporate CEOs for their intelligence. He institutionalized the idea that "all evidence of partners increasing wealth should be reserved for their private homes but never revealed at the offices". Meyer hired David Supino to write a white paper on why synergy was good for corporate America. This proved great marketing and justified the merger and acquisition business that the firm dominated. One colossus that emerged as a great man of Lazard was Felix Rohatyn. Rohatyn's ability to place himself in corporate executive's office would bring in millions of dollars in fees for his advice. Unlike firms in other sectors of the investment banking space, M&A did not require the investment firm to put up their own money. He capitalized on the shift in Corporate America looking to take advantage of the synergies Supino wrote about to become conglomerates.

Andre Meyer doubled down on the idea of Lazard as banks' advisory business and hire "Great Men" who would be valued by corporate CEOs for their intelligence. He institutionalized the idea that "all evidence of partners increasing wealth should be reserved for their private homes but never revealed at the offices". Meyer hired David Supino to write a white paper on why synergy was good for corporate America. This proved great marketing and justified the merger and acquisition business that the firm dominated. One colossus that emerged as a great man of Lazard was Felix Rohatyn. Rohatyn's ability to place himself in corporate executive's office would bring in millions of dollars in fees for his advice. Unlike firms in other sectors of the investment banking space, M&A did not require the investment firm to put up their own money. He capitalized on the shift in Corporate America looking to take advantage of the synergies Supino wrote about to become conglomerates.Harold Geneen bought into conglomerate America worked closely with Felix Rohatyn for some of the largest acquisitions at that time. The unabashed executive is credited with saying, "Gentlemen, I have been thinking. Bull times zero is zero bull. Bull divided by zero is infinity bull. And I'm sick and tired of the bull you've been feeding me." This type of CEO and banker made acceptable the structuring of enormous companies and enormous fees for banks. Due to the industry's only recent emergence, Rohatyn as a generalist was able to advise in multiple arenas whereas today companies look for industry specialized advisory firms. According to him, "M&A advisors initiate, analyze, negotiate, & coordinate M&A deals". Part of his success stemmed from being able to sit on company boards and their advisory banker (this was later banned under the Sarbanes-Oxley Act). He was known for wanting sole contact with the corporate decision makers and limiting younger bankers access and growth as future leaders. A quote about Felix that I think encapsulates the internal resentment against him, "What's the difference between God & Felix? God doesn't think he's Felix".

One takeaway from this period:

Felix Rohatyn learned the hard way that his own firm's lawyer represented the firm at his own expense and he should have sought his own legal counsel. During the congressional hearings, Felix met with the attorney general on ITT's behalf alone to discuss the need for the merger. This was attacked as improper after the Attorney General dropped the antitrust suit. Felix became notorious as a wheeler and dealer in banking and politics lambasted by the media.

Felix Rohatyn learned the hard way that his own firm's lawyer represented the firm at his own expense and he should have sought his own legal counsel. During the congressional hearings, Felix met with the attorney general on ITT's behalf alone to discuss the need for the merger. This was attacked as improper after the Attorney General dropped the antitrust suit. Felix became notorious as a wheeler and dealer in banking and politics lambasted by the media.One such deal that resulted in scrutiny was the ITT's acquisition of Hartford Fire Insurance Company. The deal became contingent on the IRS allowing ITT stock to be tax-free to Hartford shareholders. The IRS did allow this and wanted ITT to sell the Hartford share it already owned (at the time of the ruling owned 89.1 million shares). To comply, ITT sold the shares to MedioBanca(which had a friendly banking relationship with Lazard) as a holding company to appear as if the shares were not on their books. The IRS later said this did not comply and ITT paid tax consequences for Hartford shareholders who were penalized due to their own greed, while Lazard settled several suits out of court.

As leadership changes within the firm occurred and employees like Felix began trying to exit the firm, new "Great Men" were sought. Steve Ratter was brought into the firm with a strong background in junk bonds to handle "special situations" targeting emerging growth companies. This was never the firm's plan, however, and he ended up specializing in media and communication company mergers due to his background and connections in the press. David Supino brought in as head of bankruptcy advising services. The firm followed the market trend in having specialized advisers for banks/insurance, telecoms/technology, oil/gas, etc.

The M&A cycle climaxed with the RJR Nabisco deal where Felix advised the Board of Directors on bids. Then in 1989, completed deals began blowing up due to the debt load of the conglomerate companies. Many of these firms accomplished their purchases through high-interest loans and bridge loans that were not renewed by debtholders. This led to a sharp drop in equity prices, allowing for foreign Japanese Investment firms and employee buyouts to purchase companies at lower valuations. In this downturn, companies like Lazard looked to new sources of revenue to supplement their profits. Municipal bond offerings provided great sources of revenue and firms like Lazard leveraged their connections through politics and name brand to get the best deals. Lazard got the New Jersey Turnpike bond offering even though it was a new entrant to the municipal bond offering arena."While by no means illegal, the fee-splitting arrangements between Lazard Feres & Merril Lynch is a symptom of the underregulated Municipal finance industry, where political connections can often bring more dividends than the substance of an underwriter's proposal and where hidden conflicts often abound". As scrutiny of these deals intensified, many accused the banks of yield burning (overpricing of securities) for their own benefit. After the congressional hearings, Rohatyn's reputation needed rebuilding. He joined the New York City Municipal Assistance Corporation to keep the city from bankruptcy. He held regular meetings with the press to explain the goings on and in doing rebuilt his goodwill in the community. Lazard and Felix worked for free on the MAC but received enormous benefit from press. This parallels with how Lazard handled the French currency speculation in the 1920s.

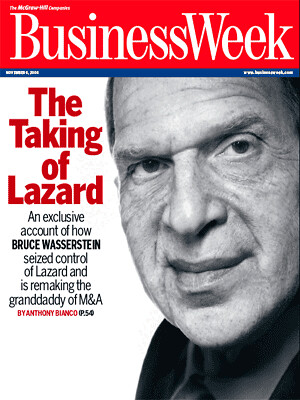

The final portion of the book deals with a path forward for the struggling firm. Mismanagement under Michael David-Weill left the firm looking for the M&A firm to itself be bought out, restructured, or going through a public offering. Michael brought in Bruce Wasserstein. His eagerness to have Bruce in the firm forced him to give far more control over the firm than to any other Head of Banking. Bruce in his career would advise companies to utilize a two-part tender offer during a hostile bid. First, offer cash to gain quick ownership control of the firm and then offer stock to those who held out. This combination put pressure on holdouts to give up control faster or lose out. Bruce got picked by KKR a large investment firm to bid for RJR Nabisco becaues the previous month Burce being on the board of Macmillian Publishing board provided confidential informaton on bid offerings to KKR to help them secure the bid.

Interesting Stories:

1)1967 "back-office crisis" - as financial markets rapidly expanded, wall street firms did not have the staffing for processing the paperwork and accounting. Quality suffered, processing times increased, and made brokerage firms increase personnel costs.

2)1970 election of candidate leftist Chilean President Salvador Allende- ITT helped the CIA prevent his election and donated "up to seven figures" to prevent Allende from taking office.

3)Supposedly Andre Meyer's hurdle rate for investments was 150% profit or not worth it to the firm to personally undertake the project. Andre wanted to buy Franco Wyoming's assets. After determining the takeover would return 197%, Lazard announced a tender offer and physically walked into the boardroom to announce the takeover completion. After liquidating the oil and gas company, Lazard netted 25 million dollars and ushered in the age of the hostile takeover.

4)Under Michael David-Weill, Lazard began hiring more women, minorities, and associates from graduate schools. The introduction of computers according to the book was the "democratization" of wall street. Suddenly WallStreet needed more college-educated men and women to work spreadsheets.

5) In 1969 there were 6,107 m&a deals worth 23.7 billion dollars compared to 1981 2,395 deals worth 82.66 billion dollars.

6) Felix worked with Oppenheimer's mutual fund business selling to his corporate clients for a time. In doing so he learned who the key operators of the fund were and helped Michael poach Herb Gullquist and Norman Eig to Lazard to found Lazard's own fund.

7)Former Lazard employee John Grambling bought RMT Properties (an American subsidiary of Canadian Husky Oil Ltd). The purchase price was 30million but he needed 100 million to run the firm. Grambling did a leveraged buy out through the Bank of Montreal along with a personal loan to pay for supposed expenses as a result of the buyout. He personally guaranteed the loan and put up Dr. Pepper stock as collateral which he would be supposedly selling to Frostmann Little & Co (New york based Private Equity Group) on Jan 22 1985. It was later revealed Frostmann closed the Dr. Pepper deal on February 28th 1984 and there was no way he could own the shares. Grambling claimed Lazard was aware of the deal and had Montreal call a Lazard VP who did not deny the wrong date because he may not have known of Grambling's accounts or was himself involved in the scam. Someone forged a Lazard partner's signature stating that Grambling had the stock and Montreal called a dummy phone number for the partner who supposedly signed (never call a number given to you if you are trying to verify, do your own search for the person). Once the Montreal bank attempted to collateralize the Dr. Pepper stock after the funds had been paid out to Grambling, they realized the form was signed incorrectly. Turned out that Grambling was running a ponzi scheme. The prosecutor gave the VP Montreal called for verification immunity before realizing that he was likely involved. He has been giving Dennis Levine inside information on Lazard m&a deals for years - also discussed in Barbarians the Gates.

8)Bruce Wasserstein was involved in the Texaco Pennzoil deal which resulted in the biggest jury award at that time, 11.1billion dollars, against Texaco. The decision resulted in Texaco declaring bankruptcy. The suit occurred due to Bruce's belief he could break up the already agreed upon merger between Getty Oil and Pennzoil by offering more to Getty and covering any legal costs that might arise for the the majority owner, Gordon Getty.

9)Bruce pioneered the "Street Sweep" which is subsequently no longer allowed. A firm would launch a hostile bid at X price, then drop the offer and buy on the open market at X+1 price. As shareholders would rush to exit the position, Bruce would be able to buy huge chunks of control in a company.

10)Michael David-Weill (head of Lazard after Meyer) felt "the optimum number" of partners to be twelve, since "it's possible to get that number around a conference table". Voltaire's Candide- The British executed own admiral who lost an important battle to "encourage the others" Michael demoted several partners to make being a partner more meaningful.

11)Billy Loomis the first Head of Banking under Michael pushed for structural reform by having more productive partners along with strong relationships between Lazard's three core markets. He wanted more autonomy over hiring and firing but was later removed from Head of Banking due to Michael wanting to retain control of his family's company.

Lazard pioneered:- Selling Memoranda- used to solicit bids for a public company.

- Toehold- Lazard helped ITT buy 6% of Hartford Fire Insurance Company(5th largest property and casualty insurer in the country) as leverage in discussion between the companies.

- Bear hug- ITT makes $1.452 billion hostile offer for Hartford.

No comments:

Post a Comment